What Actually Happens When You Transfer Your Health Benefit Plan To Kibono

The truth is, most business owners are unknowingly overpaying for a Health Benefits Plan that does not contain any insurance whatsoever; they are simply paying for an administrative service that could easily be achieved at a fraction of the cost by using a Health Spending Account instead.

Brokers and Insurers market ‘Health Benefit Plans’ with Drug, Dental, Optical, Medical as insurance. It’s not. These are simply claim reimbursements and you’re paying a fortune for it. Health Spending Accounts can fix this flawed plan design.

If you have ever looked at your company’s benefits bill and thought, “Why does this cost so much? ” — you’re not alone and this is by design.

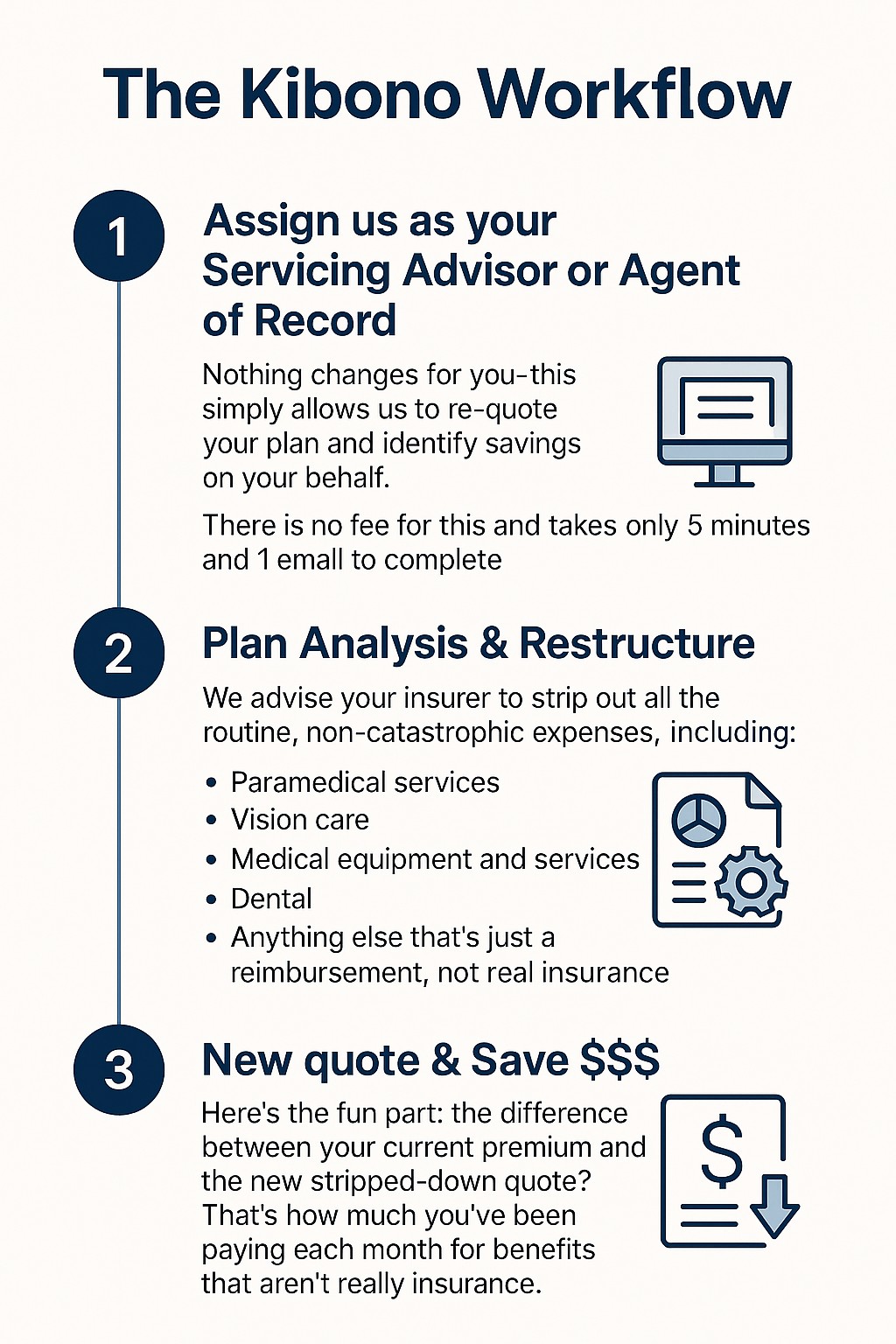

Here’s exactly what happens when Kibono steps in and takes over a group benefits plan to make things right.

How We Identify Instant Savings In Your Health Benefits Plan

Once you allow us to review your plan you will instantly see what your previous broker was reluctant to show you (bye bye big commission!) We make things right. Here’s how.

3 Easy Options: Only YOU Can Decide

- Keep your plan as-is

Love your plan? Great — no changes needed. But now, at least, you know what you’re paying for. - Scale it back and pair it with a Health Spending Account (HSA)

Keep real insurance (like Life & Disability), and pay for the rest — dental, vision, chiro, etc. — through a simple, tax-effective HSA. - Ditch the plan altogether and go HSA-Only

Sometimes the insurance becomes too costly but you want to maintain routine benefits for your employees like Drug, Dental, Optical, and Medical through a simple, tax-effective HSA.

Some Business Owners DO NOT Want Insurance

“There’s no right answer. Just more informed choices once you actually understand what you are buying“

Here’s what most brokers won’t tell you. A lot of business owners don’t even care about the insurance portion of their plan.

There’s no rulebook. No obligation to do what everyone else is doing. It’s your business — your call.

So, you can:

- Take our advice and switch over

- Ignore it and carry on

- Or find a hybrid that works for your team and your budget

There’s no “right” answer — just more informed choices once you actually understand what you’re buying.

If A Health Benefits Plan Sounds Too Good To Be True…

I saw an ad the other day: “Premium Benefits at a Fraction of the Cost.”

It made me laugh.

That’s like saying you can get a Ferrari for the price of a Toyota — you’d know something’s off; right?

The truth is, there are only two ways to save money on benefits:

- Choose a lower-tier coverage option under your traditional plan OR

- Restructure your plan with a Health Spending Account (HSA) and save on premiums for ‘non-insurance’ services such as Drug, Dental, Optical and Medical reimbursements

That’s it. No tricks. No hacks.

But if we can help you see where the costs are actually coming from — you can finally do something about it.

How to get started with a Kibono Health Spending Account (HSA)

If you’re curious what this could look like for your company, we’re happy to walk you through it.

No pressure. No fluff. Just clarity.

Or reach out directly — we’re here when you’re ready.

Kibono Resources

- Check out www.kibono.ca for more information

- Self-Sign Up or White-Glove Onboarding at no extra charge

- Same-Day setup

- Only $2.25 + 5.25% per claim

List of CRA Eligible Medical Expenses & Practitioners

- CRA List of Eligible Medical Expenses

- CRA List of Eligible Medical Practitioners