“Most group insurance plans are not protecting your business —they’re quietly profiting from your blind trust”

When it comes to protecting your business and team, choosing the right group insurance plan is critical. But what if the coverage you trust is notprotecting you at all?

A Doctor’s Wake-Up Call

I recently met with a doctor who had a standard group insurance plan from a major Canadian provider. His primary concern? What would happen if he, a team member, or a loved one were hit with a serious illness. It’s a logical worry—that’s exactly what insurance is supposed to cover.

But as we reviewed his benefits booklet line by line, something alarming surfaced. There was nothing in his group insurance plan that offered real protection against catastrophic illness. The very risk that kept him up at night? Totally uncovered.

The Illusion of Coverage

This is the unfortunate reality of many group insurance plans in Canada. Business owners believe these plans will provide a safety net during medical emergencies. In truth, most are designed to cover minor, routine expenses like dental cleanings, massages, and vision care—not major health events.

According to the Canadian Life and Health Insurance Association (CLHIA), standard group benefits plans focus largely on routine and paramedical services. Unless custom-designed, they often lack the coverage needed for high-cost illnesses.

The doctor still wanted support for everyday expenses. But he also needed meaningful, life-altering coverage. So, I took action.

The Data They Don’t Want You to See

I went back to the insurer and asked for a re-quote. I also requested claims data: how much had the group paid in, and how much had they received in return?

Their response? Silence.

Why? Because his group insurance plan was pooled with dozens—maybe hundreds—of other Canadian businesses. In pooled plans, customization disappears. Even worse, most providers won’t share claims data. They rely on a model where premiums flow into one large pot, and transparency disrupts that model.

For a helpful breakdown of pooled plans in Canada, see this resource from Sun Life.

Why They Keep You in the Dark

Here’s why insurers avoid transparency:

- If you saw you were getting more in claims than you were paying in, you’d stay and double down.

- But if you realized you were only getting pennies back on the dollar, you’d walk—and others would follow.

To protect their profit margins, insurers hide the data. If Canadian business owners saw the truth behind their group insurance plan, many would opt out.

Who Really Benefits?

Let’s be honest: most group insurance plans aren’t built to protect you. They’re designed to maximize insurer profits. You think you’re paying for peace of mind. In reality, you’re likely subsidizing someone else’s dental bill while the insurer keeps 25–30% in administrative and profit margins.

The Canadian Federation of Independent Business (CFIB) notes that small businesses often pay disproportionately into pooled plans without seeing proportional value—especially when transparency is lacking.

Red Flags You Can’t Ignore

If your benefits provider can’t or won’t provide basic claims reporting, take notice. You wouldn’t accept this level of opacity from your accountant or investment advisor. So why is it okay from your group insurance plan provider?

Across Canada, business owners are overpaying for plans that offer little in return. This isn’t just inefficient—it’s predatory.

Demand Better

You deserve transparency. You deserve control. And above all, you deserve to know when your group insurance plan is working against your interests.

Stop accepting vague answers. Ask tough questions. Request detailed data. Reclaim your power and make your benefits plan work for your business—not against it.

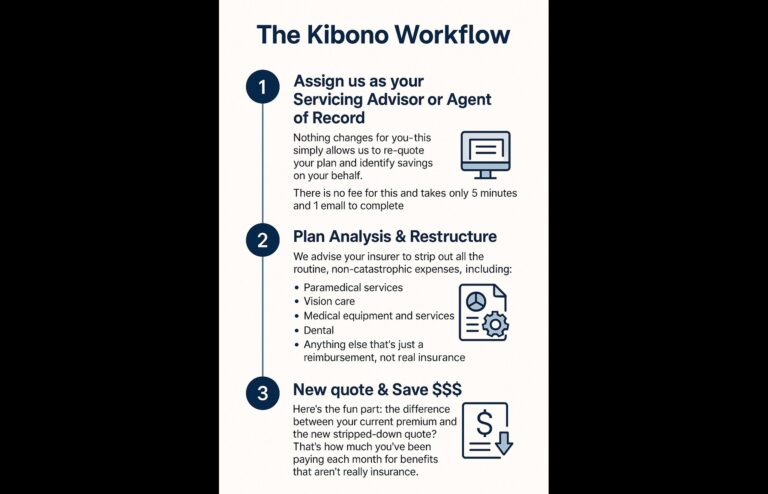

How to get started with a Kibono Health Spending Account (HSA)

If you’re curious what this could look like for your company, we’re happy to walk you through it.

No pressure. No fluff. Just clarity.

Or reach out directly — we’re here when you’re ready.

Kibono Resources

- Check out www.kibono.ca for more information

- Self-Sign Up or White-Glove Onboarding at no extra charge

- Same-Day setup

- Only $2.25 + 5.25% per claim